Retirement planning is of extreme importance when it comes to safeguarding your future. A structured and disciplined plan can help you have an independent, secured and comfortable post-retirement life.

It is a commonly known advice that one must start retirement planning in their late-20s. But we believe that it’s never too early or late to start. The best time was yesterday, the second best time is today. So, secure your future with Recipe’s guide to retirement planning.

Medical Emergencies

Medical expenditures in old age are extensive and bound to drain every penny out of you unless you have it covered with proper planning.

Inflation

Merely saving money in an FD wouldn’t help in the future if the cost of living is too much. A sound retirement plan is the only way to fight the ever-inflating future economy.

Retirement Goals

Life doesn’t end after retirement, does it? All that most of us wish for after retirement is a comfortable and healthy lifestyle. But to keep up even with this basic goal, you need to have a proper plan!

Tax Saving

Along with inflation, taxes also contribute to the degrowth of your funds. But, thanks to proper planning, you can eliminate or lessen its impact!

A perfect blend of human expertise and technology to guide you smoothly through your financial journey. Be it your basic living expenses or post-retirement staycation or a house in the woods or any of your dreams, Recipe has got it all covered. Analyze your goals and design action plans on Recipe coz clever is adjusting your plans and not goals!

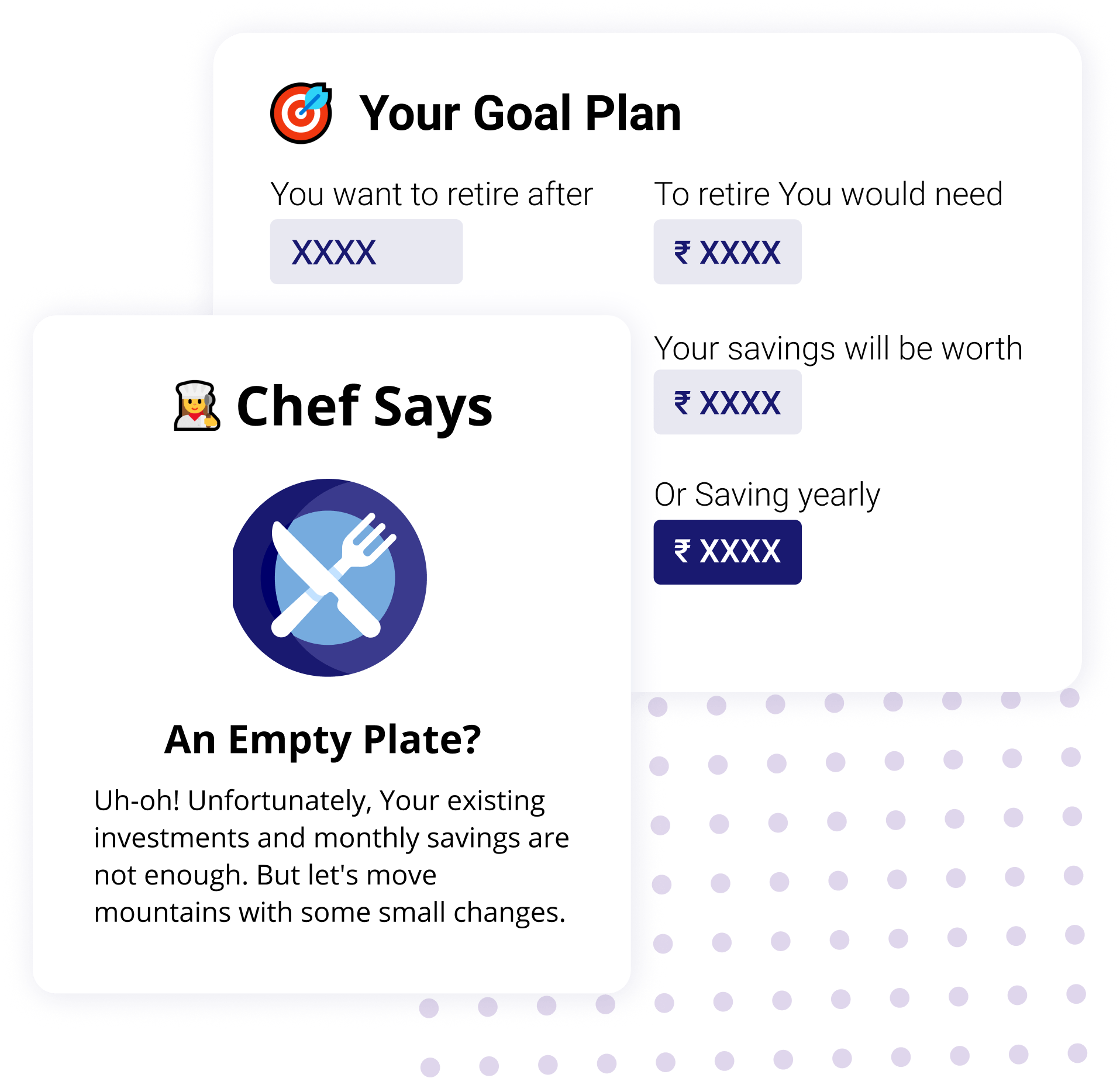

We say, modify your plans and not your dreams! Recipe’s Chef tells you when you need to replan your journey to best align with your goals and then you can adjust your plans. Chef’s Suggestions are meant to help you mould your financial habits in the best of ways to achieve your objectives on time.

There’s a lot beyond the obvious in each financial product. These attributes skip the picture often overshadowed by aggressive selling and product-push. But not anymore! With Recipe’s Secret Tips, know what your advisors might not tell you about your financial plans and be prepared to cope with all investment-related matters.

Ask anything, we would love to answer

There is no perfect time to start with retirement planning. At different stages in life, your financial profile may look different. However, it is advisable to begin retirement planning in the early years of life. Typically, retirement planning includes three phases of investment, accumulation, and withdrawal. The first phase should start when you can afford to save or invest a fair amount. It is essential to understand your risk-taking ability in terms of age, income source, and more considerable expenses such as a child’s education, loans, and marriage while planning your retirement.

Few steps that you should follow while planning your retirement corpus :

1. Assess your current financial position

2. Identify your risk appetite

3. Evaluate your post-retirement requirements

4. Find out the total corpus required considering your desired retirement age

5. Start investing

The thumb rule for retirement planning is - the earlier you start, the more you save. However, with age, your priorities change too. So, you need to factor in the cost of living in the present vis- a -vis future, your financial obligations as well as healthcare costs.

You retire from work, not life. You may have a new set of dreams for your post-retirement life. At the same time, you may also want to maintain your day-to-day lifestyle without worrying about expenses. By planning your retirement in advance, you can define the path to achieve these life goals without worrying about your income sources. You need to plan your retirement to maintain the standard of living, to be emergency ready, to fight inflation and to leave a legacy.

Retirement planning is a multistep process that evolves over time. To have a comfortable, secure and fun retirement, you need to build the financial cushion that will fund it all.

First, you need to analyze your expenses. This will help you in your pre–retirement phase i.e., the accumulation phase, to determine how much you should save for your post-retirement lifestyle. While planning retirement, you should also keep in mind the rate of inflation as in the long term, the average rate of inflation will have an impact on your planning.