- Recipe

- Goals

Goal Calculators

Goal Calculators

You don't need a Goal Planner

Financial goal management is complicated. Add to it spreadsheets, long calls, mis-selling and hefty fees… It becomes over-complicated! But no more. NO more human biases, NO complications, NO thick charges. Recipe is here to change the way you plan your goals!

And guess what? With its progressive tools, you can do it all by yourself! Why pay for a financial goal planner when you can DIY for free?

2.8L users have created their goals.

2.8L users have created their goals.

What is Financial Goal Planning?

Aka financial goal management, it is a systematic approach to planning one's investment journey, encompassing a range of activities aimed at creating a roadmap for achieving every short and long-term financial goal. The goals and their priorities change with one's age and lifestyle.

Goal Planning for Early Career:

During this phase, the emphasis is on building a solid financial foundation. A financial goal may include creating an emergency fund, paying off student loans, starting to save for retirement, and laying the groundwork for a strong credit history.

Goal Planning for Mid-Career:

As responsibilities grow, financial goal management becomes more intricate. Goals may encompass buying a home, planning for children's education, boosting retirement savings, and expanding investment portfolios.

Goal Planning for Pre-Retirement (50s):

Approaching retirement, individuals focus on accelerating their retirement savings, paying off major debts, and fine-tuning investment strategies to ensure a comfortable retirement.

Goal Planning for Retirement:

In retirement, the focus shifts to managing accumulated wealth and generating income from investments.

If you don’t have a goal, You’ll never get there! Create goals.

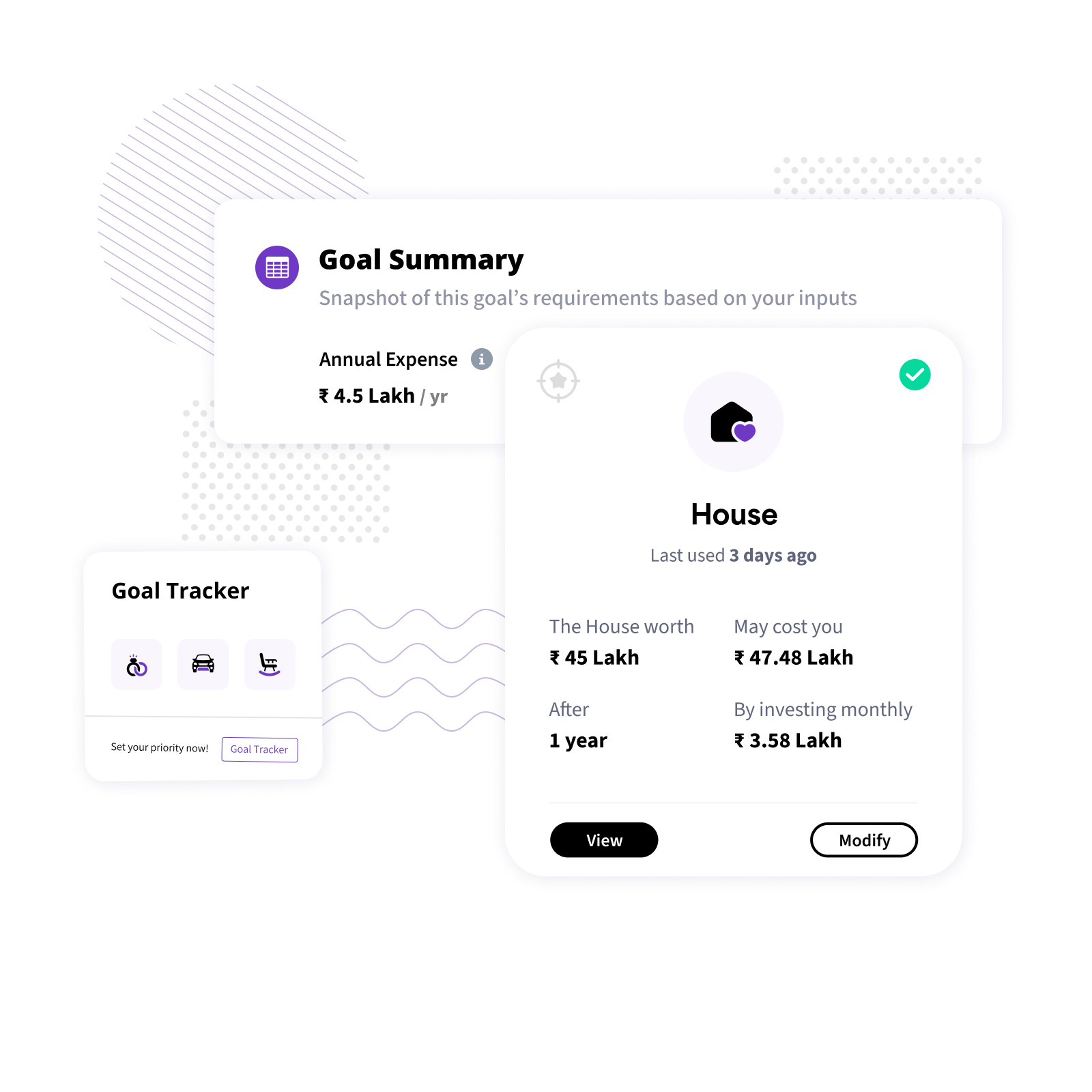

With Recipe’s smart DIY tools, create your financial goals and know how much to invest.

Use Goal Calculators

Important Financial Goals

Every individual has different goals. However, some goals are common for most people.

Buy a Car

Strategically planning for major expenses like purchasing a car involves assessing budgetary constraints, exploring financing options, and aligning the purchase with overall financial goals.

Buy My House

Buying a home is a monumental financial milestone. Effective home planning requires evaluating affordability, mortgage options, and long-term financial impact.

Retirement Planning

Retirement planning ensures financial security during post-employment years. This involves estimating retirement expenses, optimizing pension & provident benefits, and building a diversified investment portfolio.

Wealth Creation Planning

Wealth planning involves managing and growing accumulated assets while minimizing tax liabilities. Comprehensive strategies encompass estate planning, asset allocation, and risk management.

Self Education Planning

Seeking quality education requires meticulous planning. It involves estimating future education costs, exploring education savings accounts, and aligning investment strategies with educational goals.

Child Education Planning

Providing quality education for children requires meticulous planning. Child education planning involves estimating future education costs, exploring education savings accounts, and aligning investment strategies with educational goals.

Child Marriage Planning

Planning for a child's wedding necessitates setting aside funds for the celebration. Child marriage planning includes setting a budget, exploring investment options, and optimizing returns to ensure a memorable event.

Vacation Planning

Taking well-deserved vacations involves budgeting, travel cost estimation, and aligning leisure goals with overall financial planning.

Calling your dreams "goals" is a financial offence.

Introducing, India's 1st tool to set practical goals & make them possible.

Find out how