Child Education Planning

Investing in a child education plan is an essential financial responsibility for every parent. Providing a quality education not only equips your child with the necessary knowledge and skills but also opens doors to various opportunities.

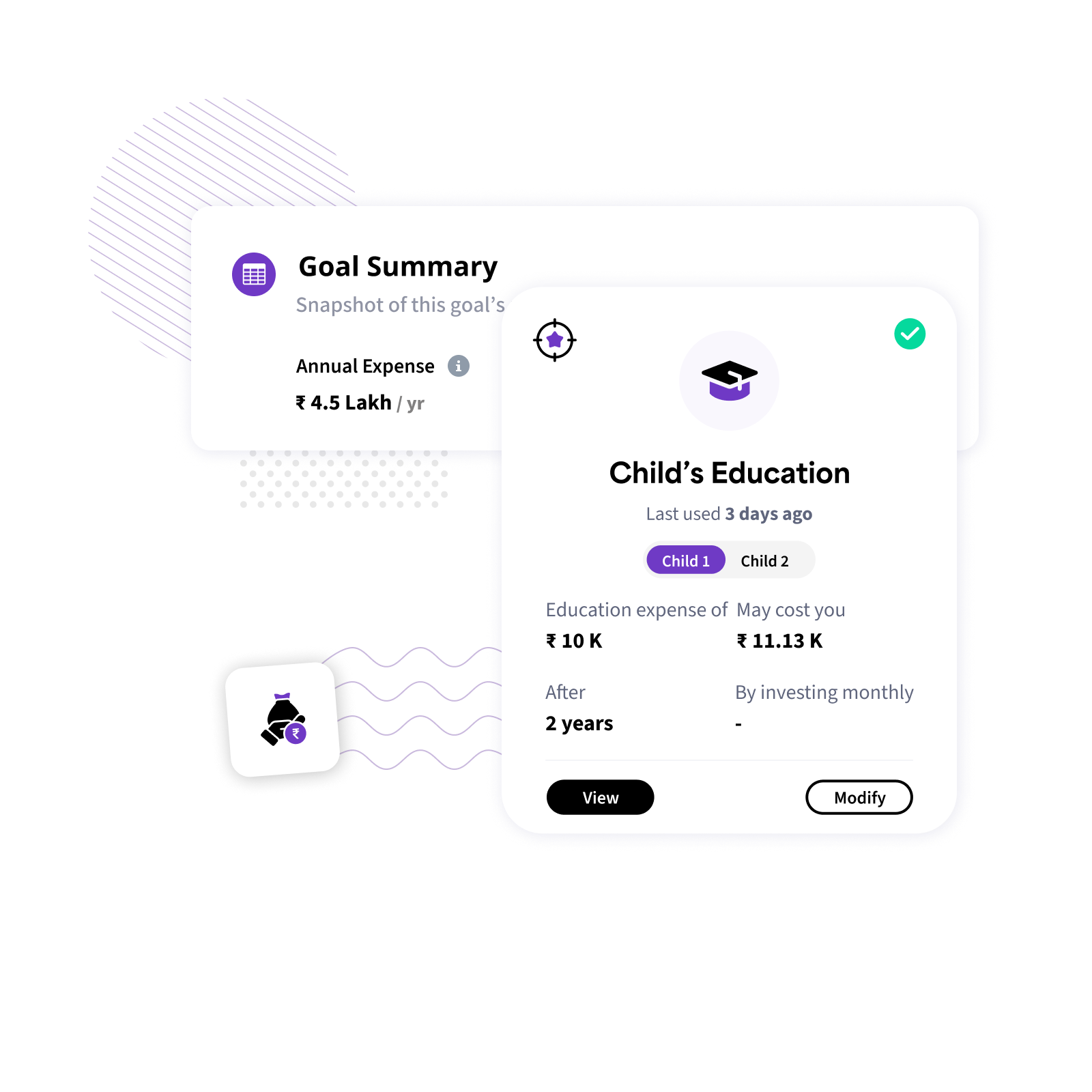

Recipe's goal calculator aims to guide you through the important aspects of planning and child education investing based on your inputs, ensuring that you make informed decisions and are financially prepared for their academic journey.

28k users created this goal.

28k users created this goal.

Calling your dreams "goals" is a financial offence.

Introducing, India's 1st tool to set practical goals & make them possible.

Find out howHow to Plan for Your Child's Education?

A child education plan can answer your question if you want to know “How to plan for child education in India?". To plan for your child's education, start by estimating future education costs, setting clear goals, and investing in a child education plan, such as mutual funds or fixed deposits. Then, regularly review your savings, explore scholarships or loans, and ensure life insurance coverage for financial security. You can use a child education calculator to know how much you need to invest in your child’s education.

Start Early - Child Education Planning

One of the crucial factors in a successful child education plan for your child's education is to start as early as possible. The cost of education is continuously rising, making early planning even more critical. By starting early, you get more time to save and invest, potentially benefit from compounding returns, and minimise the financial burden when it comes time for your child's higher education.

Money Needed For Child Education

To save up for a child education plan, first, estimate the amount of money you would need to provide for your child's education. Consider factors such as tuition fees, books, uniforms, extracurricular activities, accommodation (if applicable), transportation, and any additional expenses associated with the chosen educational institution. It's important to factor in inflation as education costs tend to rise over time. You can enter these values in a child education plan calculator and find out exactly how much you need to invest in your child's education

Budget and Savings Plan For Child Education

Investing in your child's education, you need to develop a detailed budget and savings plan that aligns with your financial goals. Creating a child education budget involves assessing your current income, expenses, and saving capacity. Cut back on unnecessary expenses and redirect those funds towards your child's education savings.

Explore Education Financing Options

Before you invest in your child's education plan, explore education financing options like education loans or scholarships. Research the terms and conditions of different loan providers, compare interest rates, and analyse the repayment plans. Scholarships and grants are also worth investigating, as they can significantly reduce the financial burden.

Understand Investment Options

Having a child education plan before you invest in your child's education can potentially grow the funds over time. Consider different investment options such as Fixed Deposits, Mutual Funds, recurring deposits, or education-specific savings schemes. Consult with financial advisors to understand the risks and returns associated with each option and make an informed decision based on your risk appetite and investment horizon.

If you don’t have a goal, You’ll never get there! Create goals.

With Recipe’s smart DIY tools, create your financial goals and know how much to invest.

Use Goal Calculators