Retirement Planning

Retirement, a phase of life marked by the culmination of one's professional journey brings with it the promise of leisure and relaxation. However, to truly enjoy the golden years, careful retirement planning is crucial.

68% of Indians haven't planned for their retirement. Around 80% of Indians invest their retirement funds in life insurance policies and fixed deposits, which can barely beat inflation. Use Recipe’s DIY Retirement tool to invest in your retirement starting today.

52.6k users created this goal.

52.6k users created this goal.

Calling your dreams "goals" is a financial offence.

Introducing, India's 1st tool to set practical goals & make them possible.

Find out howHow to plan for your Retirement

Retirement planning is an essential financial strategy that involves setting aside funds during one's working years to ensure a stable and fulfilling retirement. Once you are retired, ensure that you don’t carry any debt. This process includes evaluating current financial resources, projecting future expenses, and creating a financial roadmap that aligns with retirement goals. A key aspect of successful retirement planning is wealth creation – building a robust financial portfolio that generates income and growth well into retirement.

Retirement Planning in Early Career

Emphasis is on setting the foundation for retirement. Involves contributing to employer-sponsored retirement plans like pension and provision funds. The goal is to start early, taking advantage of compounding interest to build wealth over time.

Retirement Planning in Mid Career

With increased responsibilities, retirement planning shifts to optimising contributions to retirement accounts, exploring investment strategies, and considering the feasibility of retiring early. Diversifying investment portfolios becomes crucial during this period.

Pre Retirement Planning

Focus is on assessing retirement readiness. Individuals aim to have a clear estimate of retirement expenses and assets. Maximised contributions to retirement funds and debt reduction are essential steps.

Post Retirement Planning

The focus shifts to managing the retirement fund and making strategic withdrawals. Ensuring sufficient income streams, including pensions and social security, is vital to maintaining a comfortable lifestyle.

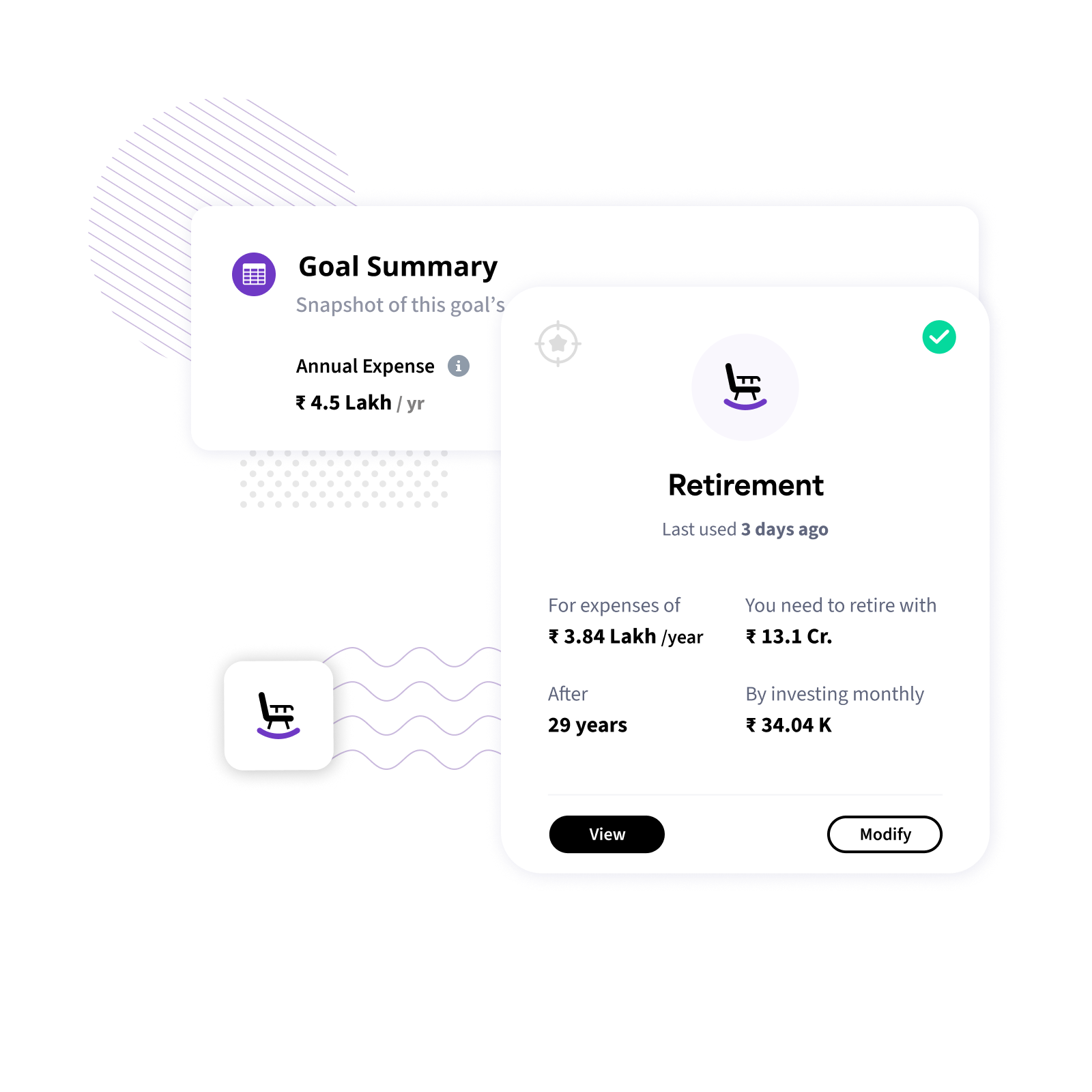

If you don’t have a goal, You’ll never get there! Create goals.

With Recipe’s smart DIY tools, create your financial goals and know how much to invest.

Use Goal Calculators

Retirement Investment Avenues

Diversify investments in retirement accounts like EPF, NPS, mutual funds, and annuities. Ensure you have adequate insurance coverage, including health and life insurance. Regularly review and adjust your financial plan based on inflation, market changes, and evolving needs.

Pension Plans

Pension plans offer guaranteed income during retirement. These employer-sponsored plans ensure retirees receive a predetermined amount regularly. Understanding the nuances of pension plans is vital, as they often come with vesting periods and different payout options.

Investment and Portfolio Diversification

Comprehensive retirement planning involves creating a diverse investment portfolio to balance risk and return. Combining stocks, bonds, real estate, and other assets can help maintain stable growth and income streams throughout retirement.