Wealth Creation Plan

Building wealth is the ultimate goal of the majority. But it is not an overnight process; it’s a strategic approach that requires careful planning and diligent execution. While your wealth creating journey may seem daunting, it is crucial to start planning and investing as soon as you start earning.

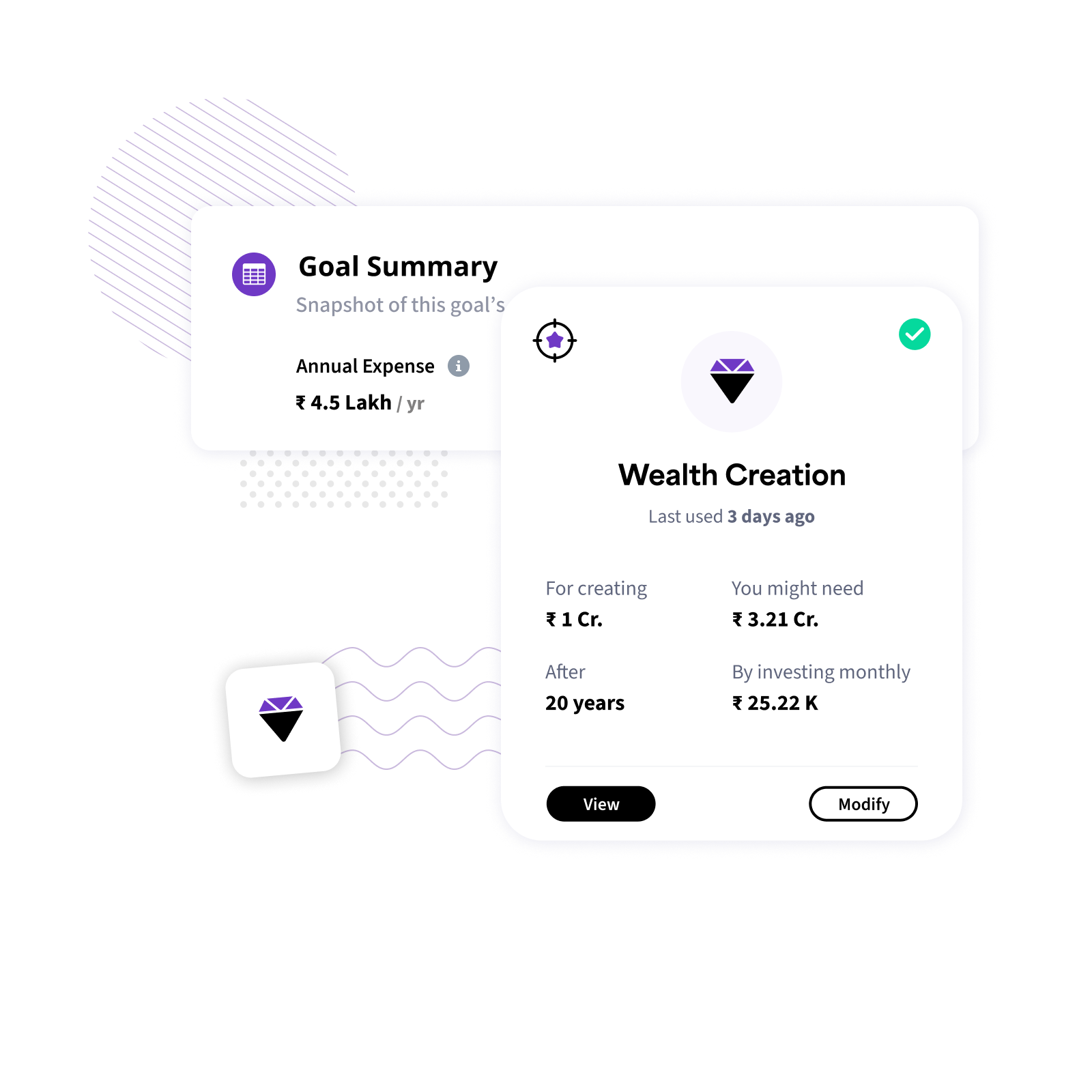

With Recipe’s DIY Wealth Creation planner, start early and build wealth in the long term without stress.

52k users created this goal.

52k users created this goal.

Calling your dreams "goals" is a financial offence.

Introducing, India's 1st tool to set practical goals & make them possible.

Find out howHow to plan for your Wealth Creation

When it comes to wealth creation, investments play a significant role. Almost 87% of wealthy individuals accumulate their wealth through equity instruments. This indicates that investing in stocks, mutual funds, and other financial instruments can be a powerful wealth creating tool. But first, start from the basics!

Creating a Budget and Managing Expenses

A crucial aspect of wealth planning is controlling your expenses and creating a budget. Tracking your expenses, identifying areas of overspending, and making necessary adjustments can free up funds for investments and accelerate wealth creation.

Setting Financial Goals

One of the fundamental aspects of wealth planning is setting clear financial goals. Whether it is retiring comfortably, buying a house, or starting a business, defining your objectives will help direct your financial decisions. Setting realistic and measurable goals will enable you to create a roadmap for wealth accumulation.

The Diversification Advantage

While investments offer the potential for high returns, they also come with inherent risks. Creating a well-balanced and diversified portfolio is crucial to control and mitigate these risks. Diversifying your investments across various asset classes, such as stocks, bonds, real estate, and commodities, can help you manage risk effectively.

Seeking Professional Guidance

Sure, wealth creating can be an independent task, but seeking professional guidance can significantly enhance your financial prospects. Financial advisors and wealth managers possess the knowledge and expertise to help you navigate the complex world of investments, tax planning, and asset allocation. Their insights can help you make informed decisions and maximise your wealth creation potential.

Regularly Review and Adjust Your Wealth Plan

Wealth planning is an ongoing process that requires regular review and adjustments. Over time, your financial goals may change, and market conditions may fluctuate. Adapting your wealth plan and investment strategy accordingly is important to ensure that you stay on track towards your goals.

If you don’t have a goal, You’ll never get there! Create goals.

With Recipe’s smart DIY tools, create your financial goals and know how much to invest.

Use Goal Calculators