Buy My House

Owning a home is a dream in life, right? It represents stability, security, and a place to call your own. However, the journey of a house purchase involves complex planning. Worry no more!

Recipe outlines a home planning timeline based on age, providing you with insights into achieving your dream home at the right time.

60.6k users created this goal.

60.6k users created this goal.

Calling your dreams "goals" is a financial offence.

Introducing, India's 1st tool to set practical goals & make them possible.

Find out howHow to Buy a House at Your Age?

Home planning is a multi-level process that involves crafting a strategy to achieve the goal of home ownership. It has various stages, from selecting the ideal property, creating a budget, and ultimately making the purchase. A key aspect of house purchase is aligning your financial resources with your vision of the perfect home. As per the Global House Price Index report, India ranks 14th amongst the 56 countries tracked in terms of appreciation in residential real estate prices. This is why planning the purchase of a house is important.

Buy My House in Early Career

Focus is on building a solid financial foundation. This stage involves setting aside funds for a down payment, improving credit scores, and exploring affordable home options. This is an ideal time to lay the groundwork for future home purchases.

Buy My House in Mid-Career

With increased responsibilities, home planning shifts to considering the needs of a growing family. Budget planning for a home becomes crucial, involving evaluating housing expenses in relation to overall financial goals.

Buy My House in Pre-Retirement

May be looking to downsize or relocate. Home planning includes assessing housing options that align with retirement plans, such as healthcare facilities.

Buy My House in Retirement

Retirement demands further adjustments to your home budget. From moving to a retirement community to downsizing to a smaller, manageable property, it involves ensuring that housing expenses are aligned with retirement income sources.

If you don’t have a goal, You’ll never get there! Create goals.

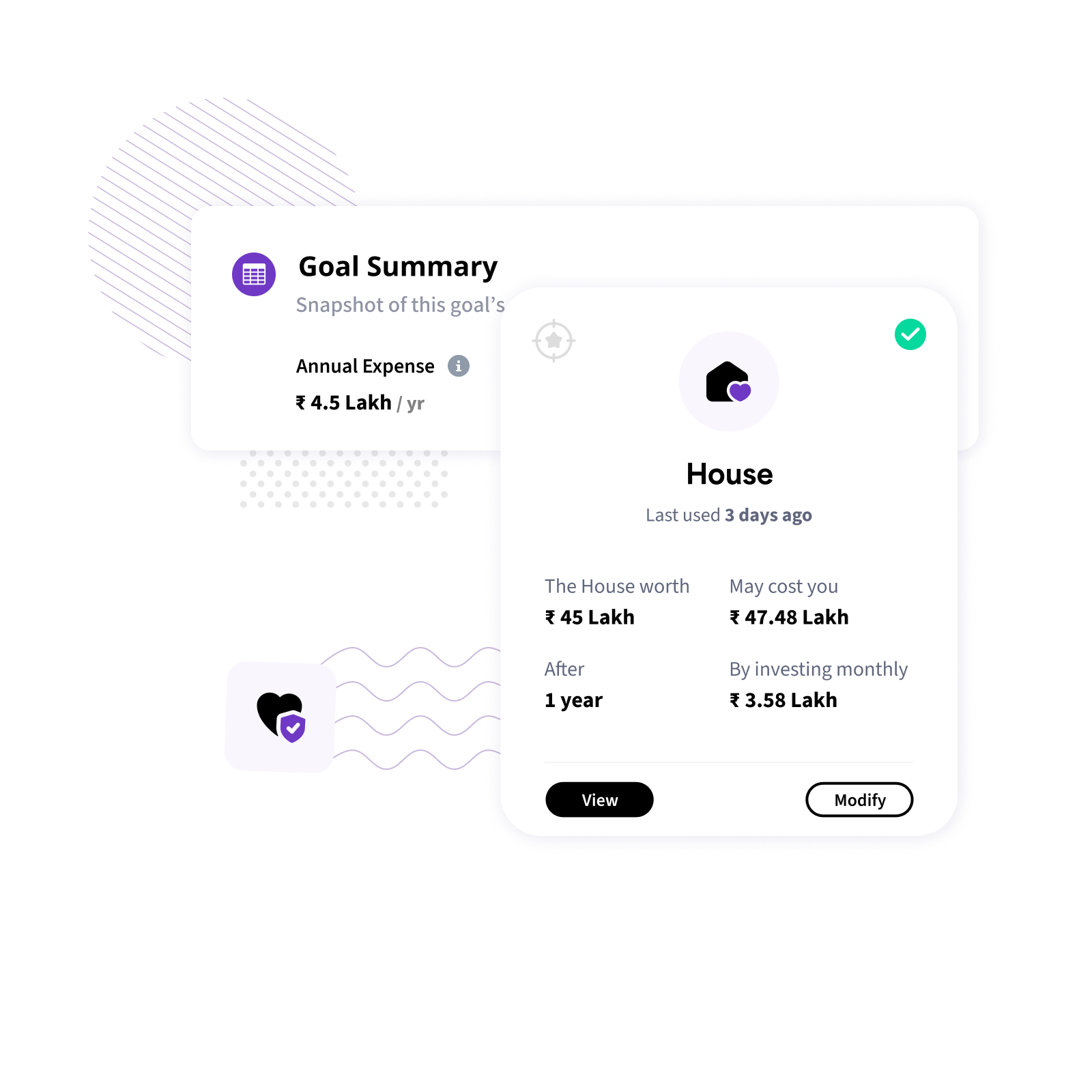

With Recipe’s smart DIY tools, create your financial goals and know how much to invest.

Use Goal Calculators

How to Plan for Your Dream House?

At Finology Recipe, we understand the significance of planning in achieving your dream house. Our state-of-the-art DIY tool is designed to provide you with insights and strategies. Whether you're looking to buy a home, budget effectively, or explore different types of home budgets, our tool offers solutions that align with your aspirations.

Buying a Home

Purchasing a home involves multiple considerations, including location, size, convinience, and budget. Home planning includes researching available properties, evaluating affordability, and assessing long-term value.

Budget Planning for Your Dream Home

Creating a budget for your dream home is a crucial step. This involves evaluating your current financial situation, factoring in your down payment, mortgage costs, maintenance expenses, and other associated costs.

Investment for Your Dream Home

When planning a home investment, start by assessing your budget and investing. To grow your capital, invest in savings schemes like stocks, mutual funds, fixed deposits or real estate-specific plans. Prioritise a good credit score for better loan approval and account for hidden costs like maintenance, property taxes, and registration fees. Planning early and setting a realistic timeline ensures smoother home ownership.