Child Wedding Planning

The growing expenses associated with weddings have made it more important than ever to plan and prepare for your child's marriage well in advance. Marriage investment plans have become increasingly essential as marriages have turned into costly affairs in recent times. While it is true that the cost of a wedding can vary depending on factors like personal preferences and cultural norms, it is important to be aware of the financial implications it may have on your family's future.

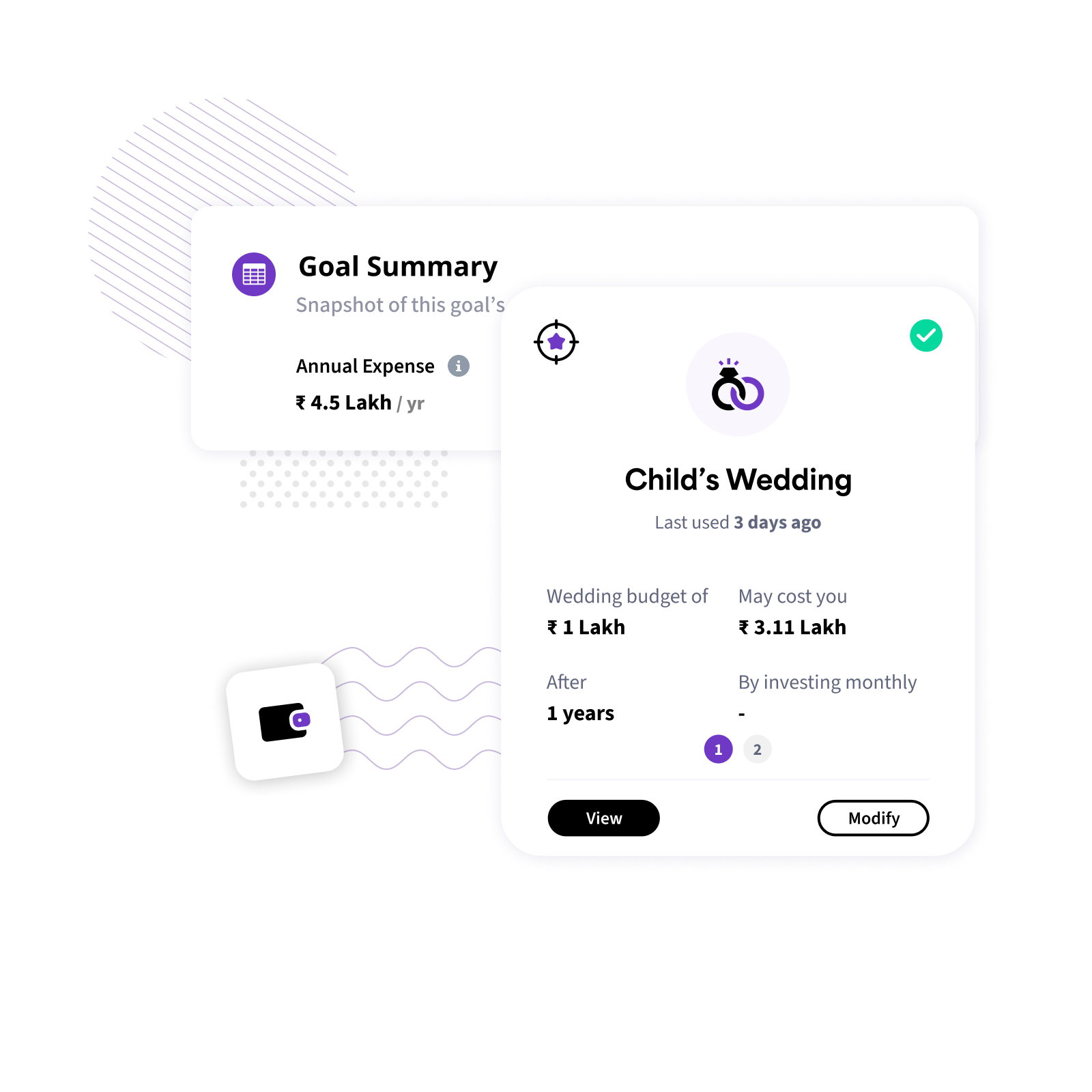

Recipe’s DIY tool aims to shed light on the financial aspects of your child’s marriage planning and provide guidance on how to save and invest for this significant milestone in your child's life.

14k users created this goal.

14k users created this goal.

Calling your dreams "goals" is a financial offence.

Introducing, India's 1st tool to set practical goals & make them possible.

Find out howHow to plan for your Child's Lavish Wedding

Child marriage planning involves estimating the total expenses early, covering venue, catering, attire, and other key costs. Set a budget and stick to it while also accounting for inflation and unexpected expenses. Early planning and child marriage investing ensure you can manage costs without compromising on the celebration.

Start Planning for Your Child's Marriage

Planning for your child's marriage should ideally begin as early as possible. You can create marriage investment plans for the same. This allows you to have more time to save money, explore various investment options, and potentially benefit from compounding returns. Starting early also enables you to distribute the financial burden over a longer period, reducing stress and financial strain while child marriage planning.

Child Marriage Budget

Creating a child marriage budget involves estimating potential costs like venue, catering, clothing, and other expenses well in advance. To achieve this goal efficiently, you can use marriage investment plans. This will help you set a clear budget, prioritise key expenses, and plan for contingencies. You can also use a child marriage calculator to help you manage finances efficiently without straining your long-term goals.

Marriage Investment Plans

Child marriage planning requires an early start and disciplined savings. Starting early ensures your investments grow steadily, reducing financial stress when the time comes. Consider long-term investment options like stocks, mutual funds, PPF, or fixed deposits to build a wedding investment plan. You can also explore gold investments or wedding insurance for added financial security. You can use a child marriage plan calculator to get a head start. Review your portfolio regularly and adjust for inflation and market conditions.

If you don’t have a goal, You’ll never get there! Create goals.

With Recipe’s smart DIY tools, create your financial goals and know how much to invest.

Use Goal Calculators